Announcing Early-Stage Investment 101

In the second program of our four-part Entrepreneurial Education Series in partnership with 1871, Early-Stage Investment 101, we will pull back the curtain on the investment cycle to teach you the in’s and out’s of raising a round. You’ll walk away from the session having learned:

· The differences between funding stages (seed, Series A, etc.)

· What are the key deal points to negotiate

· How convertible debt stacks up against equity

· Who the right investors are and how to find them

· The timeline for the investment cycle

· How to “read” a venture capitalist

· The mechanics of closing a round (deal leads, legal best practices, board seats, etc.)

If that wasn’t enough, you’ll be learning from some the most successful entrepreneurs and investors in the entrepreneurial ecosystem. Read on to learn more about our panelists.

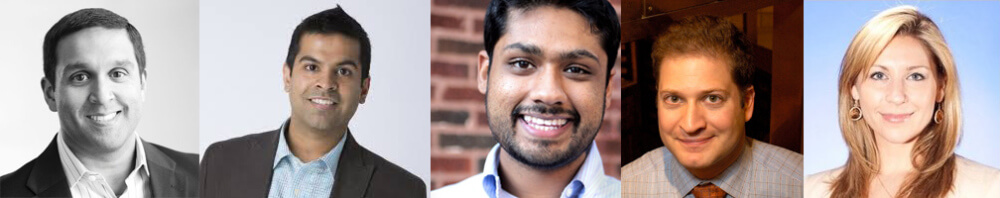

Sach Chitnis, Managing Director, Jump Capital

Sach spent six years as an Operating Partner for Tarsus, a middle-market private equity firm based in Kansas City. His operating roles spanned companies within the logistics, marketing and pharmaceutical research industries. Preceding Tarsus, Sach led the $670mm U.S. and Canadian consumer businesses for SIRVA, a Chicago-based Clayton, Dubilier & Rice portfolio company. His prior leadership roles ranged from marketing to mergers and acquisitions, and included developing corporate strategy and incubating new strategic ventures. Sach began his career with GE in global roles within their premier management programs, including the Corporate Audit Staff. He graduated with a BS in Chemical Engineering from the University of Rochester and a MBA from Northwestern University’s Kellogg School of Management.

Aashish Dalal, Co-Founder/CEO, ParkWhiz

Aashish Dalal co-founded the largest eparking provider in the world, which is now the market leader. He is a leading expert on eparking, speaks frequently at industry conferences, and is published regularly in industry trade journals Parking and Parking Today. His role as industry catalyst earned him a spot on Crain’s Chicago Tech 25 and awards from Nokia and American Express. Before creating ParkWhiz, Aashish was with IBM Global Business Services. He earned his M.S. from DePaul University and B.A. from Northwestern University. To date, ParkWhiz has raised over $12 million in funding.

Rishi Shah, Founder/CEO, ContextMedia

Rishi U. Shah, Chief Executive Officer and Founder of Contextmedia, is a successful media and technology entrepreneur who founded ContextMedia in 2006 to improve health outcomes by serving actionable health information to chronic disease patients. Today, the company’s digital place based media networks and mobile media offerings impact hundreds of millions of patient visits across 4,000+ hospital & health systems and the firm’s clients include 18 of the 20 largest pharmaceutical companies. In 2012, he co-founded a personal venture investment firm, Jumpstart Ventures, through which he has made over 30 investments in fast growing early to late stage startups. Crain’s Chicago Business recognized Rishi as the youngest ever member of their annual 40-Under-40 class in 2009 and he frequently lectures at Northwestern University’s Kellogg School of Management & McCormick School of Engineering.

Ira Weiss, General Partner, Hyde Park Venture Partners and Professor, Chicago Booth

Ira Weiss is has been an active investor in private companies for the past 15 years, and is a clinical professor at University of Chicago Booth School of Business, where he teaches course on both entrepreneurship and tax strategy. He is a managing director of Hyde Park Venture Partners and a director of Hyde Park Angels, and was formerly a managing director of RK Ventures. Ira’s primary investing interests are technology-enabled consumer and business services, and healthcare IT. Prior to Chicago Booth, Ira was a professor at Columbia Business School.

Through his work at Hyde Park Venture Partners/Angels and Chicago Booth, he helps provide valuable experiences in early stage investing to overachieving MBA students who want to be VCs.

He serves on various boards including ParkWhiz.com. He started his career as an accountant at Coopers and Lybrand, and received both his MBA and Ph.D. from the University of Chicago.

Desiree Vargas Wrigley, Co-Founder/Chief Strategy Office, Give Forward

Desiree is the Co-Founder and Chief Strategy Officer of GiveForward.com, the world’s first crowdfunding platform to help friends and family answer the question “What can I do to help?” when a loved one is in need. The platform has helped hundreds of thousands of families raise nearly $150 million while at the same time building a sustainable and efficient, venture-backed startup. She is an active mentor to other social entrepreneurs and enjoys sharing the lessons GiveForward has learned along the way as a panelist or keynote speaker.

Make sure to join us on June 17 from 6:00 pm — 8:00 pm at 1871.